The upshot: A good credit score can save you money.įor instance, according to FICO’s average mortgage interest rates on 30-year fixed mortgages as of March 2, 2023, here’s how rates vary greatly depending on your credit score.īetween the highest good score and a low score, there is nearly a $100,000 difference in interest cost.Īccording to Experian, a good credit score can also be a boon when applying for jobs, rental housing and utilities. Since you’re statistically less likely to default on your obligations, you’re considered a lower-risk borrower than someone with a history of missed payments and collections or who uses most or all their available credit. When you have a good credit score, it signals to lenders that you have a history of responsible debt management you make on-time payments and don’t take on more debt than you can responsibly handle. “A good credit score gives you so much opportunity to live life on your own terms,” says Heather Philp, who manages credit card products at Wells Fargo. Why is it important to have a good credit score?

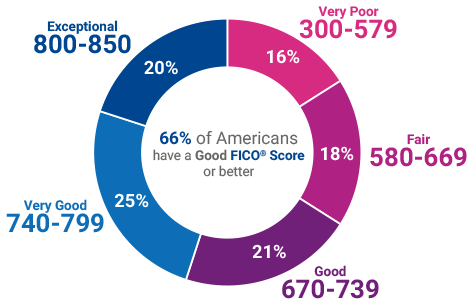

While you’ll never know the exact scoring model used when you apply for a loan, all industry-specific models rely on the same data-your credit history-to generate a score. You don’t need to worry about which scoring model a lender uses. However, credit scoring agencies also have unique scoring models for specific industries such as mortgage lenders and credit card providers, including multiple variations of each model. When you check your score, you’ll see a base score that any lender can use to determine your creditworthiness. Credit scores can also be higher or lower than the “good” middle ground.Īre there other scores than FICO and Vantage 3.0 and 4.0? In short, yes. In 2022, the average FICO score was 716 and the average VantageScore was 696. Good scores are roughly equal to or slightly above the average score of other U.S. Higher scores are considered “very good” or “exceptional.”

Vantage 3.0 and 4.0 scores-the newest scoring models-are considered “good” if they are between 661 and 780. and VantageScores both range from 300 to 850, their “good” ranges differ slightly.įor FICO, a “good” score falls between 670 to 739. While FICO scores issued by Fair Isaac Corp. Regardless of the scoring agency, all scores are designed to predict the same thing: how likely you are to be more than 90 days late on a payment in the next two years. Someone with a score rated “excellent” at one agency isn’t likely to have a score rated “poor” at another. However, van Faassen says scores between the two agencies trend close enough that you shouldn’t see a meaningful discrepancy. Since no two scoring agencies use the same “sauce,” your score can vary depending on the agency.

“Each of these scoring agencies has their own secret sauce: their algorithm,” says Rutger van Faassen, head of market strategy for Curinos, a financial industry analytics firm. and VantageScore-use information from your credit history to calculate your credit score. The two main consumer credit scoring agencies-Fair Isaac Corp. While the name implies annual access, consumers will have weekly access to their reports through the end of 2023 thanks to changes made early in the pandemic.

You can check your credit reports from all three bureaus for free-at. The three major credit bureaus-Equifax, Experian and TransUnion-track your credit history, including your credit accounts, payment history, delinquencies, collections and any authorizations you’ve given companies to review your credit file, also known as inquiries. There are two types of entities that work to create your credit score: credit bureaus and credit scoring agencies, which are separate.

0 kommentar(er)

0 kommentar(er)