Earned income includes wages, salaries, tips, other compensation, and net earnings from self-employment. These projects should use the Multifamily Tax Subsidy Project Income Limits available. federal income tax will be less if you take the larger of your itemized. The Iowa EITC must be divided between spouses in the ratio of each spouse's earned income to the total earned income of both spouses. Multiplied by the Iowa Earned Income Tax Credit must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes. Iowa net income (line 26, IA 126)Īll-source net income of you and spouse (line 26, IA 1040) (The ratio cannot exceed 100%. Per OMB Circular A-123, federal travelers.

The Iowa EITC must be adjusted using the following formula. Enter the amount of your Iowa EITC on lines 61, 65, 66, and 67. If you qualify for the low income exemption as explained in the instructions for line 26 and are filing an Iowa return only to claim a refund of the Iowa EITC, enter the words “low income exemption” in the area to the left of your net income on line 26. Form IA 1040 requires you to list multiple forms of income, such as wages, interest, or alimony.

#Iowa income tax tables 2020 pdf

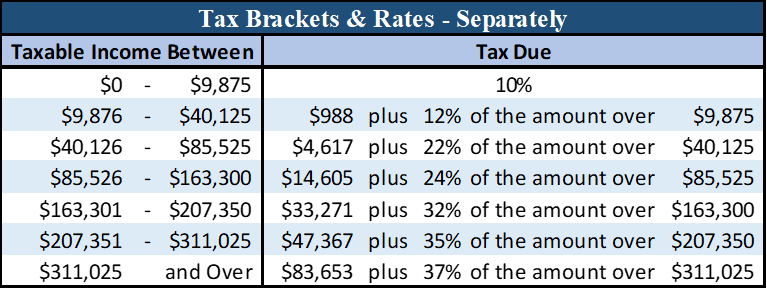

This version of IA-1040 is a PDF form that can be filled out and printed for easy filing. Your taxable income and filing status determine which tax brackets and rates apply to you. IA-1040 is the long-version Iowa 1040 income tax return, for use by all in-state residents. Sales tax provides nearly one-third of state government revenue and is second only to the income tax in terms of importance as a source of revenue. If you are filing an Iowa return ONLY to claim EITC There are seven federal income tax rates: 10, 12, 22, 24, 32, 35 and 37.

#Iowa income tax tables 2020 download

You can download or print current or past-year PDFs of IA 1040 Table directly from TaxFormFinder. To calculate the Iowa Earned Income Tax Credit, multiply your federal EITC by 15% (.15). We last updated the IA 1040 Tax Tables in February 2023, so this is the latest version of IA 1040 Table, fully updated for tax year 2022. To find out if you qualify for federal EITC, see the IRS EITC information or call the IRS at 80. The Iowa Earned Income Tax Credit is a refundable credit. This credit is available only to taxpayers who qualify for the federal Earned Income Tax Credit (EITC).

0 kommentar(er)

0 kommentar(er)